Automatize Return Customs Documentation: Return Invoice / DUA

Ability to automatize the document for returns and being able to download it. To configure it merchants need to contact Support Center

How it works?

- First of all, it is important to understnad if merchants need Custom Documentation or not

- If merchants don't need custom Documentation the iF platform will create a label in the carrier without any return invoices.

- Configure if Return Invoice is automated or not

- If Merchants don't have an automated return invoice then:

- Merchants need to upload documents on the platform. This is how merchants will see Return control window on Manage Returns screen.

After that merchants need to Approve the item and will be able to Confirm

- The label and return invoice will be created.

- Merchants need to upload documents on the platform. This is how merchants will see Return control window on Manage Returns screen.

- If Merchants have an automated return invoice then:

- It will create a return invoice

- Create a label

- If Merchants don't have an automated return invoice then:

Where merchants can download it?

- Merchants can download it either from Transportation or Manage Returns screen.

- Go to Manage Returns -> click on the Green dolar Icon.

From the Return Control of your Return Order click on the "Download Label" it will automatically download label and return invoice

- Go to Transportation -> click on the Green eye icon of order -> click on "Download label"

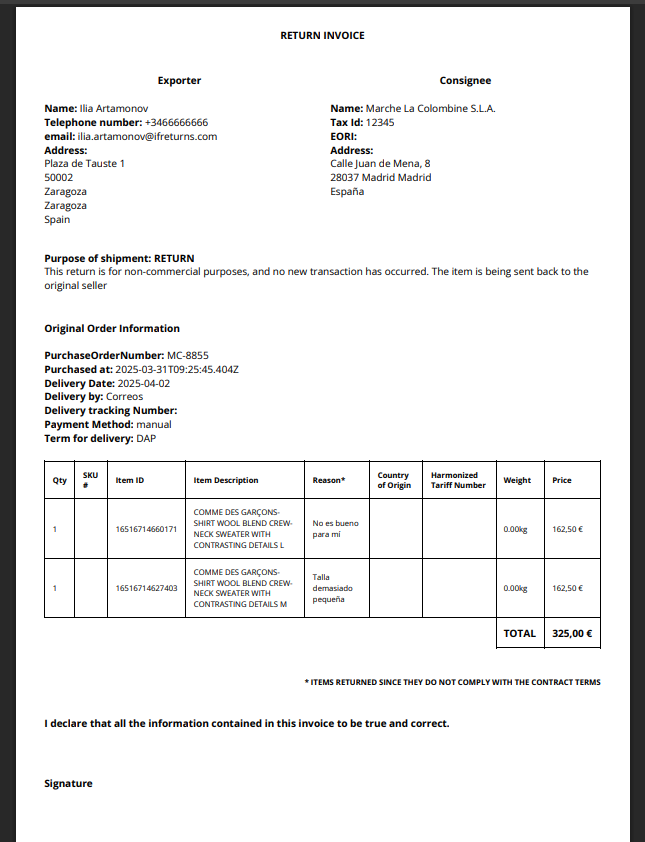

What information is included in the Return Invoice?

- Merchants can find the following information:

-

Title: Return Invoice

-

Exporter: Includes the address data from the client:

-

Name

-

telephone number

-

email

-

address

-

-

Cosignee: Includes Company fiscal information:

-

Company fiscal Name

-

Tax ID

-

EORI

-

Fiscal Address

-

- Original Order Information:

- Purchase Order number

- Original Order purchased at

- Original Order Delivered at

- Delivered by

- Delivery tracking number

- Payment Method

- Incoterm for Delivery: ‘DAP’ by default

- Line items:

- Qty

- SKU

- Item ID

- Item description:

- Reason

- Price and currency

- Harmonized Tariff Number

- Weight

- Country of Origin

- Total amount

- Airwaybill / tracking number

- Declaration

-

- See example of the Auto-generated Return Invoice: